Payment Kiosks

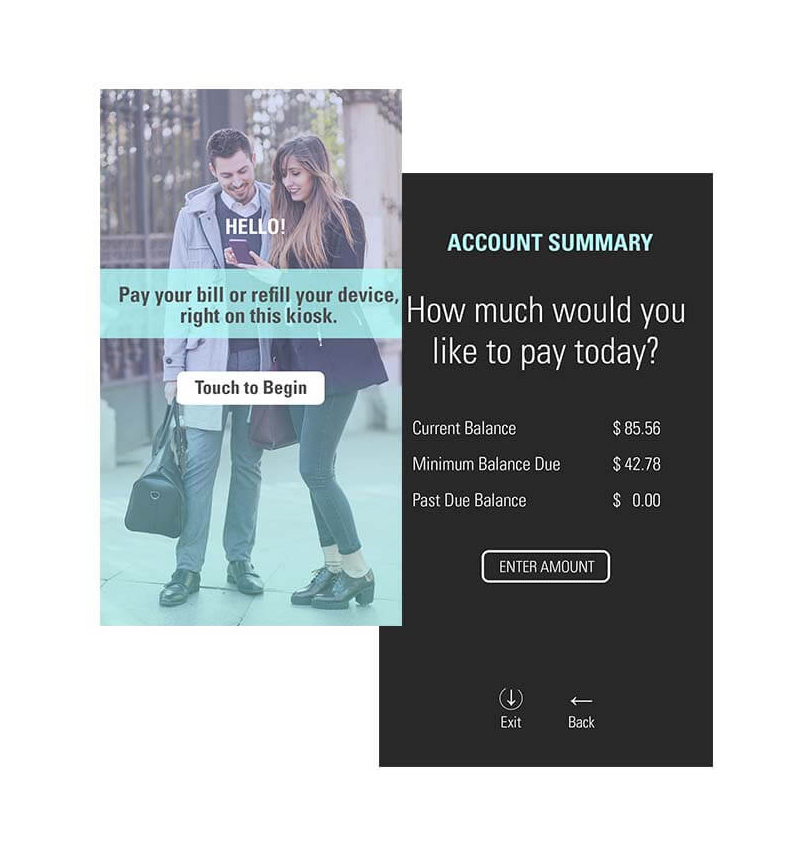

Self-service bill pay and transfer kiosks add customer convenience while reducing transaction overhead.

Convenient Bill Payment Solutions

A bill payment kiosk is a self-service terminal enabling convenient payment for various bills or services. Customers can use cash, cards, or other accepted methods to settle bills, offering efficiency and accessibility while reducing wait times.

Cash-preferred customers are the primary target for bill payment kiosks. Despite the prevalence of debit and credit cards, 25% of U.S. consumers still pay their bills with cash, checks, or money orders. In addition to cash payments, deployment data gathered shows that around 40% of bill payment transactions are conducted with debit and credit cards.

KIOSK has over 20,000 points of presence in self-service bill payment kiosks and money transfer, and offers several hardware form factors from simple card payment to robust cash-in / cash-out solutions.

Payment kiosks provide value in just about any industry where customers are billed for a service. Bill pay kiosks provide convenience to utility providers — such as electric, phone, and water — allowing the public access to a utility bill payment kiosk to make payments instead of staffing a payment window. This bill payment system can also allow for 24/7/365 access for customers who may not be able to pay their bill during normal business hours.

Bill Payment Hardware

In addition to FDIC statistics, CNBC confirms that as of 2021 almost 25% of US households are unbanked or underbanked. Underbanked, meaning they have a bank account but also use alternative financial services outside of the banking system. A solid bill payment kiosk machine offering provides an easy way for cash-preferred consumers to stay on top of their bills – up to 24 hours a day, 7 days a week.

Business and deployer benefits include:

- Automates cost-effective repetitive transactions (cash, credit, debit, check)

- Focuses staff on driving sales / more profitable activities than bill collection

- Relieves labor shortages

- Ensures secure, encrypted transactions

- Provides consistent up-sell presentation / data capture capability

Aside from servicing niche demographic needs, the need to boost retailer profitability drives continuous self-service bill payment demand. Few self-service kiosk applications can compete with the ROI and mutual benefits of bill payment.

Licensable Bill Payment Kiosk Software

KIOSK’s in-house Software Engineering Team has developed a bill payment platform that is successfully deployed nationwide with leading bill payment services and Telecom providers. This licensable software can be used as-is, or customized to include unique user flows and features. In addition to the bill payment software functionality, KIOSK’s software includes a Hardware Integration Module (HIM) enabling IoT alerting at a component level. The HIM contains a rich library of bill payment components including payment devices, printers, scanners, and many other common transaction devices.

Key application features include:

- Complete payment fulfillment options including cash, checks, credit / debit (fully secure and encrypted).

- Capability to support multiple bills and back-end payment systems, providing simple platform expansion

- Prepaid accounts / auto-replenishment by account number

- Full-feature Remote Management platform (KNECT IoT)

- Comprehensive reporting

Leveraging existing (and proven) base code and component APIs significantly reduces time and development costs. KIOSK’s base Bill Payment application manages the vast majority of common payment and billing transaction needs.

Money Transfer Solutions

MoneyGram’s payment kiosk solution enables consumers to independently stage money transfer and electronic payment transactions using a highly secure & reliable online platform. The platform is designed to deliver high-volume financial services in retail stores, banks, and post office sites throughout the US.

MoneyGram’s goal in deploying kiosks was to improve delivery efficiency for all retail partner locations. This platform replaced their old countertop phone system and automated the transfer staging process.

Let’s discuss your goals to automate the customer payment experience.

Market Applications

Solutions for any industry

No matter the market, Kiosk applications enables digital transformation through automation platforms that are easy to use, adaptable and supported by end-to-end Managed Services using IoT real-time monitoring. Whether you need a solution for self check-in, automated returns, video conferencing or ticketing, KIOSK has a solution that transforms the customer experience.

Bill Payment FAQs

The most recently published Federal Deposit Insurance Corporate (FDIC) statistics (2017) cites 6.5% of U.S. households are unbanked, equating to 8.4 million households. Another 18.7% of households (24.2 million households) fall into the under-banked category, relying on alternative financial services (AFS). That equates to over 63 million customers in legitimate need of a safe, simple and affordable way to pay their bills with cash. KIOSK’s bill payment kiosks allow customers to easily pay bills with cash, credit card, or debit card.

These FDIC statistics combined with the rising demand for consumer convenience and retailer profitability fuel consistent demand for self-service bill payment. Few self-service applications can compete with the ROI and mutual benefits of bill payment kiosks.

KIOSK’s Software Development Group has authored an advanced Standard Bill Payment (SBP) platform providing licensable code modules to support a complete base of payment transaction and account management requirements. It provides a closed loop self-serve transaction flow with highly secure payment processing, eliminating the need for expensive staff assistance. SBP is designed to streamline kiosk interaction, ensuring a positive customer experience at the center of every transaction and secure service delivery.

KIOSK’s Bill Payment software has been successfully deployed nationwide in retail locations providing electronic payment and money transfer services. Our developers have created a base user flow incorporating common payment transaction and processing functions widely utilized by leading bill pay clients. The application can be leveraged “as is” or easily customized to include client-specific flow requirements.

Licensing common application functionality reduces the customization requirements down to client API integration. This dramatically cuts custom development time and time to market by 50 – 80% (depending on the level of UI flow customization requested).

The KIOSK SBP application module includes the following:

- Transaction: Collects the transaction and bill ID, amount, payment method, cash denominations, etc. Secure transactional data is sent to our client’s API and the payment processor, as well as to KIOSK’s proprietary Remote Monitoring platform for real-time viewing. Payments can be processed with the client-preferred or KIOSK recommended processor.

- Authentication: Facilitates unique machine, data, user, and kiosk credential sets providing audit trail data needed to facilitate PCI DSS audits

- Licensing: Enables licensed users to receive automated pushes of new application features and functionality remotely.

- Remote monitoring: Provides real-time alerts and status visibility of connectivity, application and components

- Hardware Provider Layer: Enables IoT signaling from components within the kiosk, maximizing uptime. Further, it provides capability for seamless hardware integration of new components during development.

KIOSK has partnered with McAfee to create the KIOSK Security Suite. Together, we implemented an optimal bundle of embedded security technologies to manage and monitor connected transactions and guard against malware attacks. This security software is loaded along with the KIOSK SBP application to facilitate PCI DSS compliance and certification efforts.

KIOSK’s Solution Services are flexible in design, enabling customers to mix and match the service options / support hours to match specific deployment demands. Services are designed to maximize the security and field uptime of a self-service network. Service options include factory/field phone support, advanced exchange parts warranty, on-site field services, prevent and managed services.

The KIOSK SBP application is built upon KIOSK’s proprietary and licensable remote kiosk network management platform. At a high level, the KIOSK’s software solution delivers the monitoring tools for real-time network visibility and communication, coupled with a complete set of practical management tools.

Feature sets provide live data exchanges between Server and Client for monitoring status and alerts for connectivity, application status, and component status, administrative / management commands, network reporting and analytics. Establishing this advanced IoT machine dialogue with each kiosk in the field provides the vehicle to manage the entire kiosk deployment with intuitive dashboard controls. This centralized control optimizes field uptime, reduces service costs, and streamlines reporting / analytics – all directly impacting ROI.